Head And Shoulders Pattern Definition

Head And Shoulders Pattern Definition

An ascending triangle can be drawn as soon as two swing highs and two swing lows can be linked with a trendline. In actual-world software, most triangles could be drawn in slightly different ways.

As a reversal pattern, the falling wedge slopes down and with the prevailing pattern. Regardless of the sort (reversal or continuation), falling wedges are considered bullish patterns.

Traders might want to add further standards to their exit plan, corresponding to exiting a commerce if the worth starts trending towards the place. A revenue goal is an offsetting order positioned at a pre-decided worth. One possibility is to place forex a profit target at a value that may capture a value transfer equal to the complete height of the triangle. The execution is the same no matter whether or not the triangle is ascending, descending or symmetrical.

In order to avoid false breakouts, you need to wait for a candle to shut beneath the bottom trend line earlier than coming into. My personal targets are between because of robust support/psychological help, although we might even see some bounces as we go down.

Because of its shape, the sample may also be known as a proper-angle triangle. Two or more rising troughs kind an ascending development line that converges on the horizontal line because it rises. If each traces had been https://www.umarkets.com/ extended proper, the ascending development line may act because the hypotenuse of a proper triangle. If a perpendicular line have been drawn extending down from the left end of the horizontal line, a proper triangle would form.

What Are Forex Chart Patterns?

The triple backside chart pattern usually follows a prolonged downtrend the place bears are in charge of the market. While the first backside might merely be regular worth motion, the second backside is indicative of the bulls gaining momentum and getting ready for a possible reversal. The third backside indicates that there is robust assist in place and bears could capitulate when the value breaks through resistance levels. The rising wedge pattern is characterised by a chart pattern which varieties when the market makes larger highs and better lows with a contracting range.

When you trade reversal wedges you must place your cease loss order proper past the extent, which is reverse to the wedge breakout. I will start with the reversal wedges as a result of the previous chart patterns we mentioned had been the corrective wedges. The pennant is a corrective/consolidating worth move, which seems during developments. It resembles a symmetrical triangle by shape, as both are certain by trendline support and resistance strains. The difference is that pennants usually occur during a pattern part, whereas triangles may be fashioned throughout both trends and common consolidation durations.

For instance, the relative energy index (RSI) could also be used to determine when a security has become overbought following a breakout. Most traders look to initiate a short position following a excessive quantity breakdown from decrease pattern line help in a descending triangle chart sample. In common, the value goal for the chart pattern is equal to the entry value minus the vertical peak between the 2 development strains on the time of the breakdown.

The moving average indicators serve the aim of triggering the sign to initiate a commerce. This easy quantity primarily based descending triangle sample is straightforward to commerce however requires lot of time to observe the charts. The first step in buying and selling this strategy is to select a inventory that has been in a downtrend or in a consolidation section.

Traditionally, a regular descending triangle pattern is considered to be a bearish chart pattern. Chart technicians can make use of the descending triangle sample to be able to trade potential breakouts. The chart beneath shows an example of a descending triangle chart sample in PriceSmart Inc. A descending triangle is detectable by drawing pattern traces for the highs and lows on a chart. It is as much as you if you’ll shut the top and shoulders position and then open one other brief position to commerce the rising wedge.

Falling wedge

In a bullish pattern what seems to be a Rising Wedge may very well be a Flag or a Pennant (stepbrother of a wedge) requiring about 4 weeks to complete. In a falling wedge, both boundary strains slant down from left to proper. Volume keeps on diminishing and trading exercise slows down due to narrowing prices. There comes the breaking level, and trading activity after the breakout differs. Once costs move out of the specific boundary lines of a falling wedge, they are extra prone to transfer sideways and saucer-out before they resume the essential development.

What is a bearish flag pattern?

The wedges can represent ways of either making energy with no or reduced carbon emissions (like nuclear or wind-produced electricity), or storing carbon dioxide to prevent it from building up as rapidly in the atmosphere (either through underground storage or biostorage).

What is a Bull Flag Pattern?

He has over 18 years of day buying and selling experience in both the U.S. and Nikkei markets. On a every day foundation Al applies his deep expertise in methods integration and design strategy to develop options to help retail traders turn into worthwhile. When Al isn’t engaged on Tradingsim, he could be found spending time with family and friends. Measure the space from the horizontal help to the initial excessive and project this distance from the breakout stage. Traders can anticipate a possible upside breakout and trade the pattern accordingly.

When you trade corrective wedges your stop loss should be placed proper beyond the side, which is reverse to the breakout. A chart formation is a graphical depiction of a inventory’s worth movements over time.

- This sample emerges as quantity declines and the inventory fails to make recent highs.

- My private targets are between as a result of strong help/psychological support, although we may even see some bounces as we go down.

- Figure 5, then again, shows the anticipation strategy in action.

- It differs from the triangle in the sense that each boundary traces either slope up or down.

- In most circumstances, you will find that the Heikin Ashi candlesticks flip bullish prior to the breakout.

- However, the collection of higher highs and better lows retains the pattern inherently bullish.

In the identical day the price completes the dimensions of the formation – 137 pips that very same day. Since the wedge comes after a price improve, it has a reversal character. The decrease stage of the wedge gets libid damaged in bearish direction and could be a possible quick on the EUR/USD. The might be closed after two days when the worth reached the size of the formation.

quiz: Understanding rising wedge

What is an approach wedge?

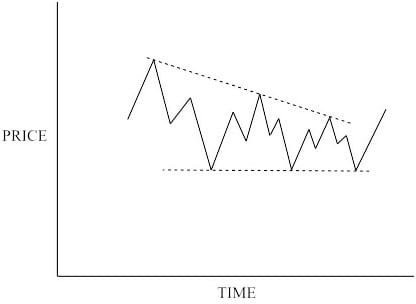

The descending triangle chart pattern occurs after the end of a retracement to a downtrend. The downside breakout from the support triggers a strong bearish momentum led decline. Instead of a flat support level, you can see higher lows being formed.

In conclusion, the descending triangle sample is a flexible chart pattern which displays the distribution phase in the inventory. Following a descending triangle sample, the breakout is commonly swift led with momentum. This can lead to strong results when one becomes acquainted with the trading methods outlined. Subsequently price motion eventually breakouts to the upside from the descending triangle reversal sample at bottom. Unlike the technique mentioned previously, in this arrange, you possibly can commerce lengthy positions.

… the rising wedge pattern alerts a possible selling opportunity either after an uptrend or throughout an current downtrend. This is measured by taking the peak of the back of the wedge and by extending that distance down from the development https://www.umarkets.com/ line breakout. ANN supplies a good instance of the rising wedge as a reversal sample that types within the face of weakening momentum and money circulate.

As within the case of a rising wedge in a uptrend, it is characterised by shrinking prices which are confined within two lines coming together to type a pattern. It indicates the continuation of the downtrend and, again, this means you could search for potential promoting alternatives.

Triangle

What does a bear flag mean?

A bullish divergence occurs when prices fall to a new low while an oscillator fails to reach a new low. This situation demonstrates that bears are losing power, and that bulls are ready to control the market again—often a bullish divergence marks the end of a downtrend.

It is certainly one of a number of prime patterns that sign, with varying degrees of accuracy, that an upward development is nearing its end. A bull flag sample is a chart pattern that happens when a inventory is in a powerful uptrend. It is called a flag sample as a result of when you see it on a chart it appears like a flag on a pole and since we’re in an uptrend it is thought of a bullish flag. Practice spotting, drawing and buying and selling triangles in a demo account before attempting to commerce these patterns with actual money. Traders can then confirm if they’re capable of producing a profit with the methods, earlier than any real capital is put in danger.

This is the day by day chart of EUR/USD for Oct 29, 2012 – Apr 12, 2013. When an ascending/descending triangle is confirmed, we count ascending triangle on a reversal worth motion equal to the dimensions of the formation.

What is descending triangle in technical analysis?

What is a Triple Bottom? A triple bottom is a bullish chart pattern used in technical analysis that’s characterized by three equal lows followed by a breakout above the resistance level.

Buy when costs breakout above the consolidation pattern on high volume. If you’re looking for free scanners to seek out bull flag patterns you possibly can take a look at Finviz or Chartmill. We introduce people to the world of currency buying and selling, and supply educational content material to assist them learn how to turn into profitable merchants. We’re also a group of merchants that assist each other on our daily trading journey. If prices fail to break the upper resistance line of the flag within twenty days, the flag sample fails.

What is a flag in forex?

A head and shoulders pattern is a chart formation that resembles a baseline with three peaks, the outside two are close in height and the middle is highest. In technical analysis, a head and shoulders pattern describes a specific chart formation that predicts a bullish-to-bearish trend reversal.

Neutral Chart Pattern – Symmetrical Triangle

Both the ascending and descending triangle are continuation patterns. Moreover, triangles show a possibility to brief and suggest a revenue target, so they’re simply completely average true range different appears on a possible breakdown. Ascending triangles also can kind on a reversal to a downtrend however they’re extra generally utilized as a bullish continuation sample.

What are the triangle types?

What is a Double Bottom? A double bottom pattern is a technical analysis charting pattern that describes a change in trend and a momentum reversal from prior leading price action. The double bottom looks like the letter “W”. The twice-touched low is considered a support level.

From that time ahead the shares went on to plunge almost 31% additional. Symmetrical triangles differ from ascending triangles and descending triangles in that the upper and lower trendlines are both sloping towards a middle level. Symmetrical triangles are additionally similar to pennantsand flags in some methods, however pennants have upward sloping trendlines rather than converging trendlines. A rising wedge in a downtrend is a short lived value motion in the opposite direction (market retracement).

As with most forms of technical evaluation, symmetrical triangle patterns work greatest at the side of other technical indicators and chart patterns. Traders usually search for a excessive volume move as affirmation of a breakout and may use other technical indicators to determine how long the breakout may last.